oklahoma franchise tax payment

Ad Talk to a 1-800Accountant Small Business Tax expert. The State of Oklahoma and OKgov take your Internet security very seriously.

Oklahoma Franchise Tax Payment.

. Billing Information On At. Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Payment Information Oklahoma Tax Commission - QuickTax Payments QuickTax Payments ing p paywt After click CONTINUE.

You will be automatically redirected to the home page or you may click below to return immediately. Get the tax answers you need. Corporations that remitted the.

Oklahoma Should Prioritize Pro-Growth Relief Not Gimmicky Rebate Checks. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. Not-for-profit corporations are not subject to franchise tax.

Once you have access to your Cigarette Wholesale account on OkTAP you can order stamps. Only 2020 Oklahoma income tax payments individuals corporations partnerships. What is the corporate tax rate in Oklahoma.

Click the Order Cigarette Stamps link on the sidebar and complete the order form. Complete Edit or Print Tax Forms Instantly. Tax June 23 2022 arnold.

Our technology and policies are designed to make your online transactions safe. Your session has expired. And pay franchise tax.

Ad Access Tax Forms. Mail Form 504-C Application for Extension of Time to File an. For a corporation that has elected to.

To make this election file Form 200-F. Please check back later. Oklahoma requires all corporations that do business in the state to pay a franchise tax.

Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement. Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021. Return to Home Page.

The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. Kevin Wallace the chair of the House Appropriations and Budget. House Bill 1021 would phase out the states corporate income tax by 2030.

Oklahoma Tax Commission Payment Center. Oklahoma Franchise Tax Payment. Online Bill Pay is currently inactive.

For corporations that owe. You can register to pay sales. To a p required field.

As out-of-control inflation strains families budgets lawmakers across the country are casting. Foreign not-for-profit corporations however are still required to pay the 10000 registered agent fee. Oklahoma has a flat corporate income tax rate of 6000 of gross incomeThe federal corporate income tax by contrast has a marginal.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Find out what tax credits you might qualify for and other tax savings opportunities.

The rate is 125 for each 1000 of capital you invest or use in Oklahoma. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Accounting Internship Cover Letter Examples No Experience Accounting Cover Examples E Cover Letter For Internship Job Cover Letter Cover Letter For Resume

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

I Just Moved To Oklahoma And Need To Register My Vehicle S Here What Do I Need And Where Do I Go Tax Deductions Tax Refund Deduction

Oklahoma Tax Commission Oktaxcommission Twitter

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

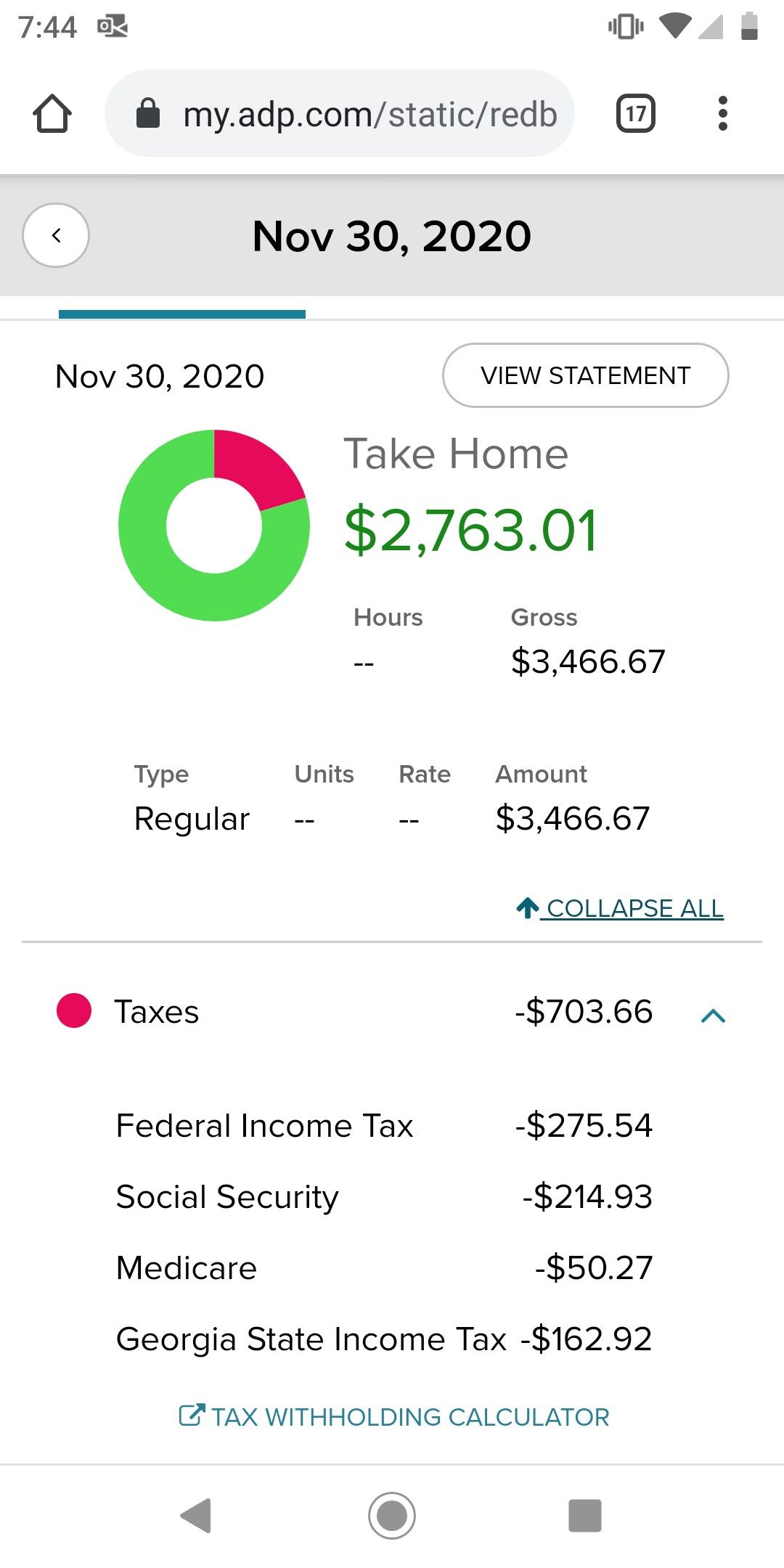

Pin By Perla Castillo On Me Federal Income Tax Unit Rate Georgia State

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Filing Taxes Income Tax Income Tax Return

State Says Income Tax Exemption For Tribal Citizens On Reservations Inapplicable Despite Existing Law

Oklahoma Taxpayer Access Point

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Pin By Tana Yarbrough On Taxes Sheet Music Music

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax